Key Findings

This Report provides an overview of the nature of the illicit trade of cigarettes across a selection of Asian markets. It establishes estimates of consumption of illicit cigarettes and the impact this has on tobacco tax revenue. This is the sixth year of the Asia Illicit Tobacco Indicator Report, providing estimates for 16 markets: Australia, Cambodia, Hong Kong, Indonesia, Laos, Macao, Malaysia, Myanmar, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam.

-

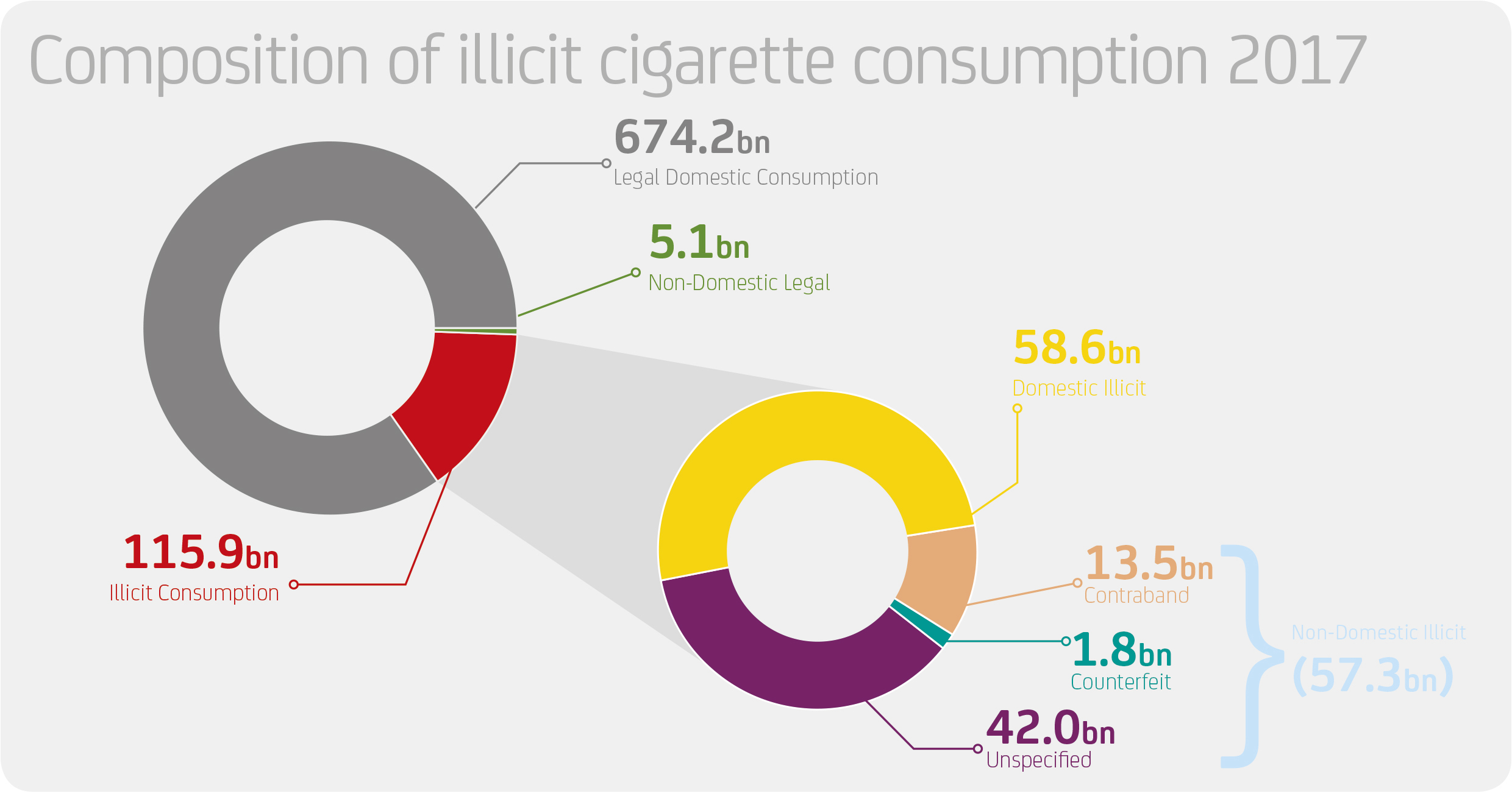

Illicit Incidence was estimated at 14.6% across sixteen Asian markets in 2017, equivalent to 115.9 billion cigarettes where the applicable indirect taxes were not paid.

-

More than three-quarters of all illicit cigarettes were consumed in three markets: Pakistan, Indonesia, and Vietnam.

-

Illicit Incidence rose in 12 out of the sixteen markets included in the Report, while four markets experienced a decline in 2017: Indonesia, Laos, Pakistan, Philippines.

-

Non-Domestic Illicit Consumption was estimated at 57.3 billion in 2017. It is composed of Unspecified Market Variant, Contraband, and Counterfeit cigarettes.

-

Unspecified Market Variant products were the largest component of Non-Domestic Illicit, accounting for over 73% of total Inflows in 2017. Over 85% of Unspecified Market Variant cigarettes were identified in Vietnam, Malaysia, and Pakistan.

-

Contraband consumption was estimated at 13.5 billion cigarettes. The largest volume of Contraband cigarettes was identified in Vietnam, Hong Kong, Pakistan, South Korea, and Thailand.

-

A total of 1.8 billion Counterfeit cigarettes were consumed in 2017. The majority of Counterfeit cigarettes were found in the Philippines (1.7 billion). Much smaller volumes of Counterfeit cigarettes were also present in Australia, Cambodia, Hong Kong, Malaysia, New Zealand, Singapore, and Thailand.

-

The total estimated consumption of Domestic Illicit was 58.6 billion cigarettes in 2017. Domestic Illicit cigarettes were identified in three markets: Indonesia, Pakistan, and the Philippines.

-

The total Tax Loss across the sixteen markets was estimated at USD 5.8 billion in 2017. Nearly 50% of the estimated Tax Loss occurred in just two markets: Australia and Malaysia.

Back To Top